Accounting Jobs in Canada: Salary Expectations, Job Search Tips and More

Did you know that the Canadian accounting industry generated approximately 26.1 billion Canadian dollars in revenue by the end of 2022 (publicly released in January 2023)? In the same period, around 1.3 million people were employed in Canada under the finance, insurance, real estate, rental, and leasing industry. Interestingly, the Canada Job Bank features hundreds of advertised job openings every month.

Accounting jobs in Canada look good? Yes, you’re correct! If you have an accounting degree and are looking for opportunities abroad or if you’re an aspiring accountant checking if accounting jobs in Canada are right for you, then you’re in the right place!

What are the Career Pathways for Accountants in Canada?

In Canada, accountants have diverse career pathways that offer both stability and growth opportunities. Here’s an overview of the career paths available for accountants in the country:

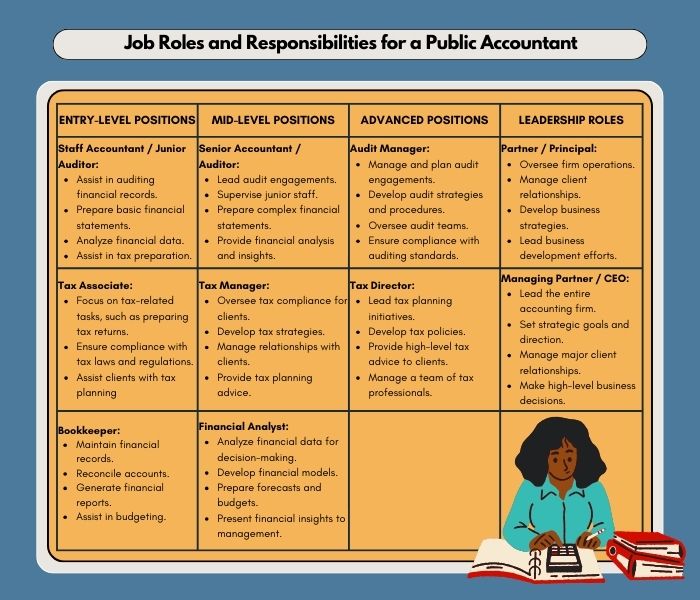

Public Accounting

Accountants in public accounting work for accounting firms that provide services to external clients. This can include auditing, tax preparation, consulting, and advisory services. Many accountants in public practice pursue certifications such as Chartered Professional Accountant (CPA).

Here’s a ladderized breakdown of job roles and responsibilities for a Public Accountant, ranging from entry-level to the highest positions:

(Click on the photo to know more)

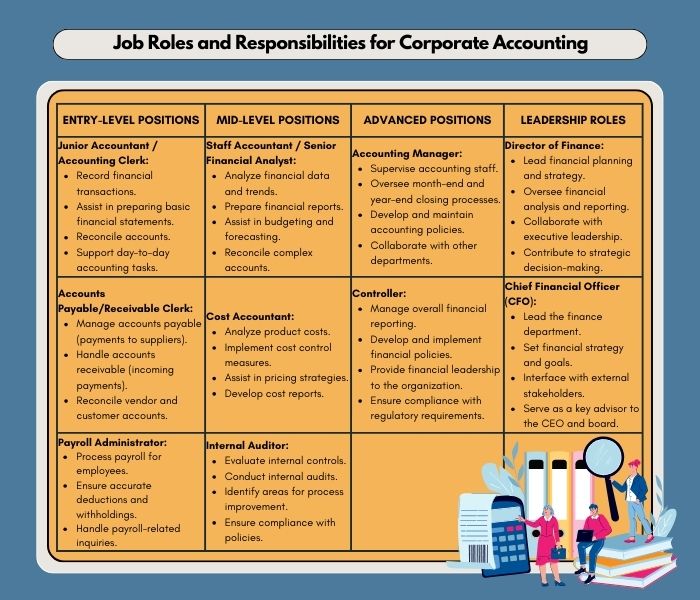

Corporate Accounting

Accountants in the corporate sector work within companies, managing internal financial processes. This includes roles in financial reporting, budgeting, strategic planning, and financial analysis to support the company’s operational and strategic goals.

Here’s a ladderized breakdown of job roles and responsibilities for Corporate Accounting, ranging from entry-level to the highest positions:

(Click on the photo to know more)

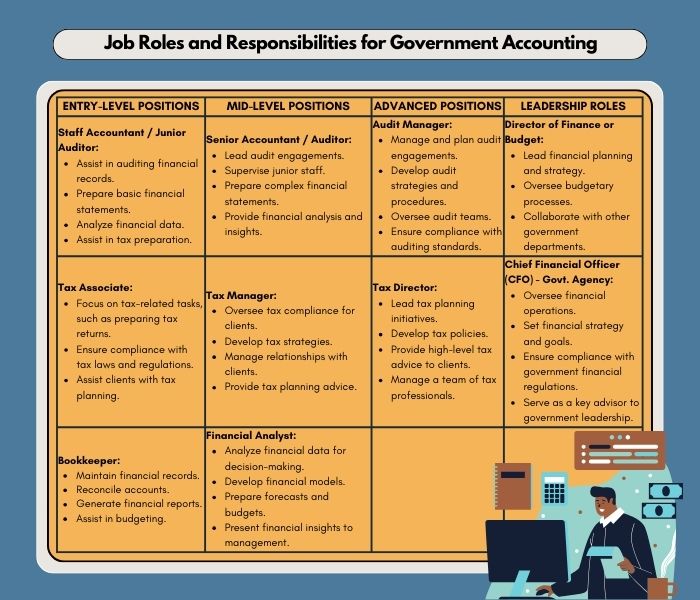

Government Accounting

Government accountants work within various levels of government, managing public funds, ensuring compliance with financial regulations, and contributing to transparent financial operations. This pathway often involves working for municipal, provincial, or federal government agencies.

Here’s a ladderized breakdown of job roles and responsibilities for Government Accounting, ranging from entry-level to the highest positions:

(Click on the photo to know more)

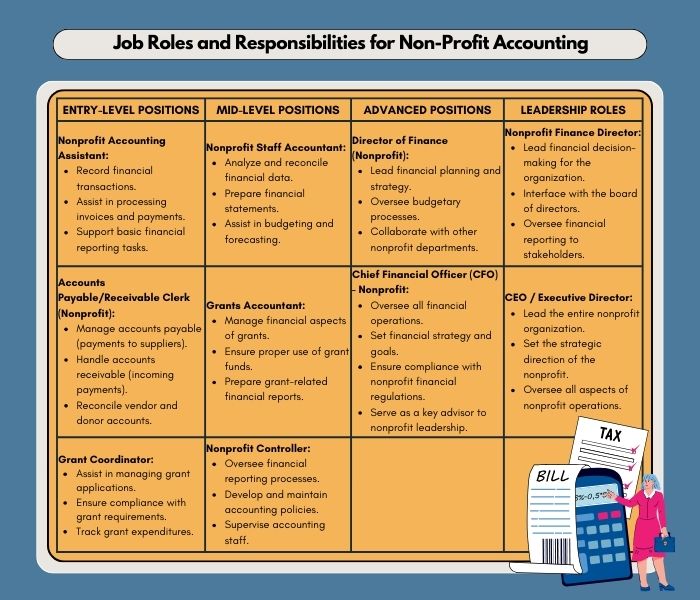

Nonprofit Accounting

Nonprofit accountants work for organizations with social or charitable missions. They handle financial matters unique to the nonprofit sector, including managing grants, donations, and ensuring compliance with specific regulations related to charitable organizations.

Here’s a ladderized breakdown of job roles and responsibilities for Nonprofit Accounting, ranging from entry-level to the highest positions:

(Click on the photo to know more)

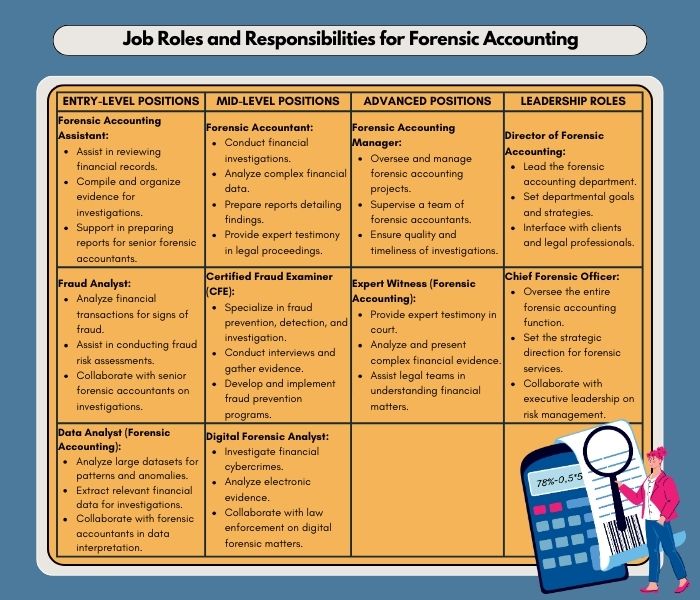

Forensic Accounting

Forensic accountants specialize in investigating financial discrepancies and fraud. They may work with law enforcement agencies, legal firms, or private organizations to analyze financial data and provide expert testimony in legal proceedings.

Here’s a ladderized breakdown of job roles and responsibilities for Forensic Accounting, ranging from entry-level to the highest positions:

(Click on the photo to know more)

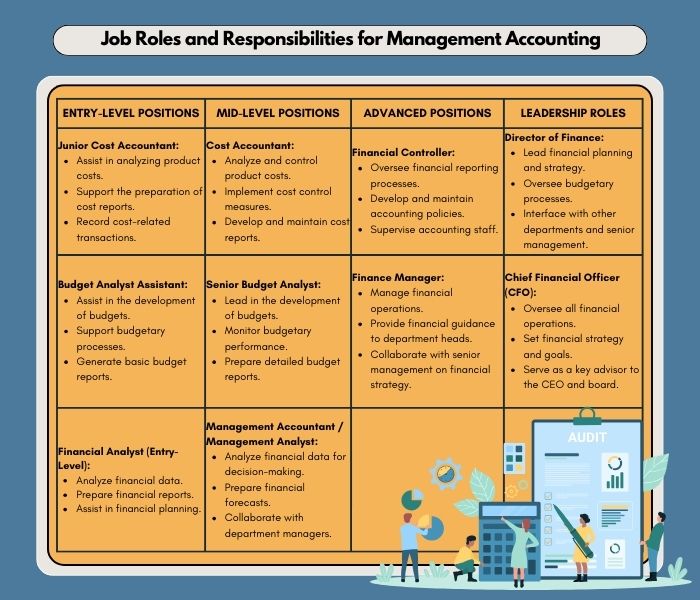

Management Accounting

Management accountants work within organizations, providing financial information to support internal decision-making. They assist management in making informed choices to achieve the company’s goals and objectives.

Here’s a ladderized breakdown of job roles and responsibilities for Forensic Accounting, ranging from entry-level to the highest positions:

(Click on the photo to know more)

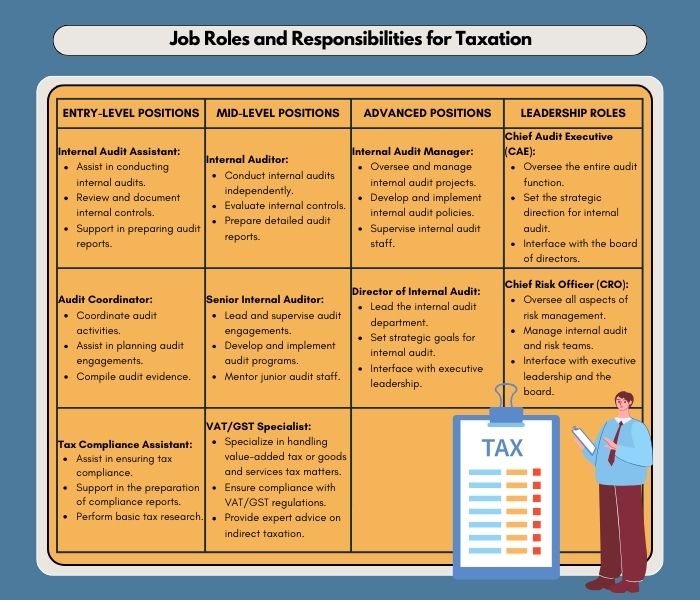

Taxation

Accountants specializing in taxation focus on understanding and applying tax laws and regulations. They work to ensure compliance with tax requirements and help individuals or businesses optimize their tax positions.

Here’s a ladderized breakdown of job roles and responsibilities for Taxation, ranging from entry-level to the highest positions:

(Click on the photo to know more)

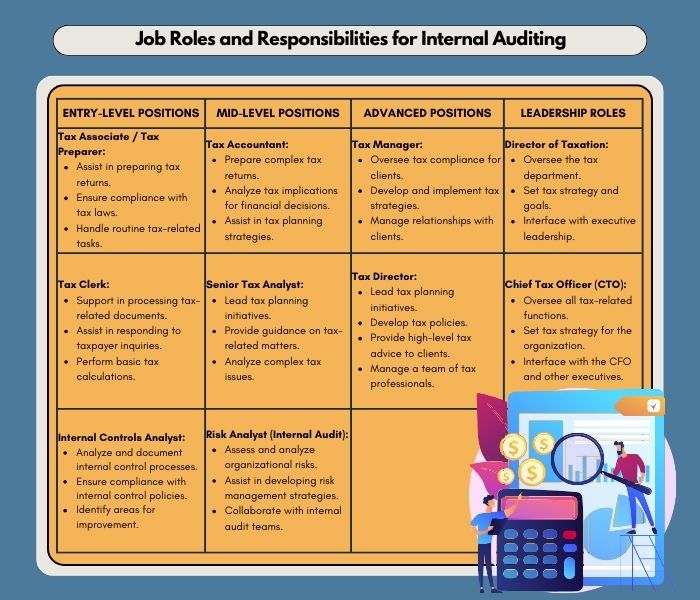

Internal Auditing

Internal auditors work within organizations to assess and improve internal controls, risk management, and operational processes. They play a crucial role in ensuring the integrity and efficiency of an organization’s internal systems.

Here’s a ladderized breakdown of job roles and responsibilities for Internal Auditing, ranging from entry-level to the highest positions:

(Click on the photo to know more)

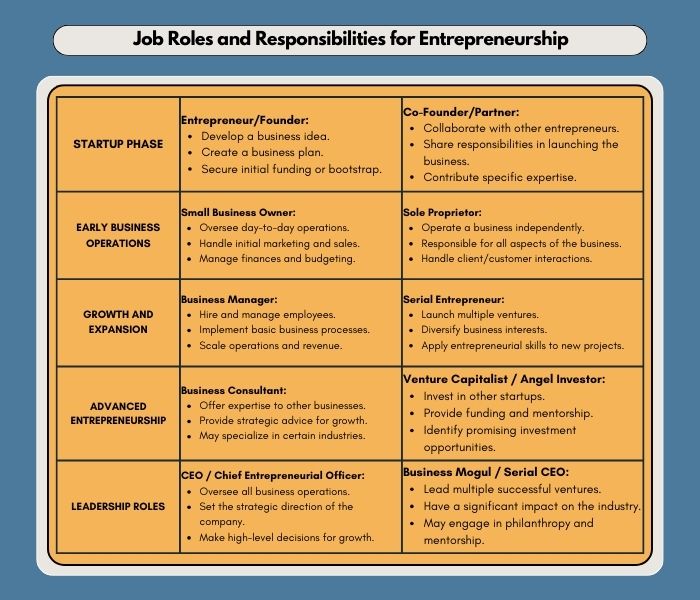

Entrepreneurship

Some accountants choose to start their own accounting firms or consulting businesses, providing services to a diverse range of clients. This path offers independence and the opportunity to shape one’s professional niche.

Entrepreneurship is often less structured in terms of job roles and hierarchies compared to traditional corporate environments. However, here’s a general progression and responsibilities breakdown for individuals involved in entrepreneurship:

(Click on the photo to know more)

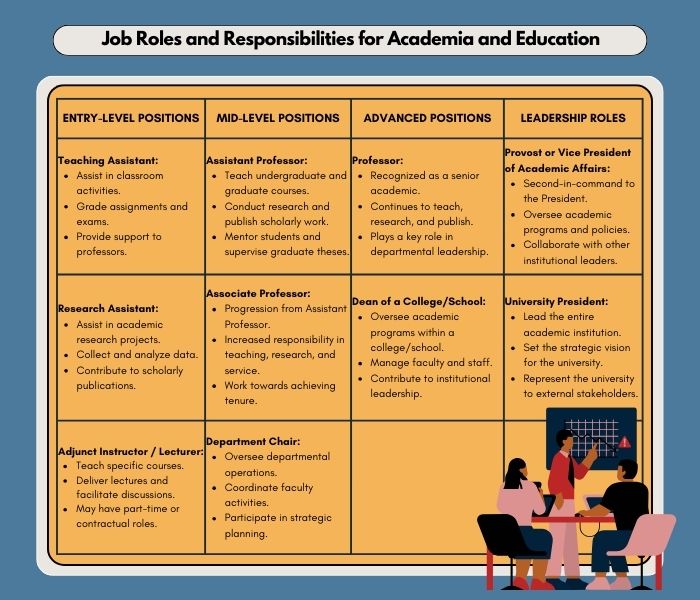

Academia and Education

Accountants with a passion for teaching and research may choose a career in academia. They can become educators, researchers, or contribute to the development of accounting curricula.

Here’s a ladderized breakdown of job roles and responsibilities for individuals in Academia and Education, ranging from entry-level to the highest positions:

(Click on the photo to know more)

Salary Ranges for Accounting Positions in Canada

It’s important to know how much money Accounting jobs usually pay in Canada. In this section, let’s talk about the kind of salaries you might expect in Canada. Whether you’re just starting or looking for a higher-level position, understanding these salary ranges can help you plan your career better. Let’s dive in!

| ENTRY-LEVEL POSITIONS | Average Salary: 10,000 CAD to 20,000 CAD |

|---|---|

| MID-LEVEL POSITIONS | Average Salary: 10,000 CAD to 20,000 CAD |

| ADVANCED POSITIONS | Average Salary: 10,000 CAD to 20,000 CAD |

| LEADERSHIP ROLES | Average Salary: 10,000 CAD to 20,000 CAD |

Quick Links:

Job Search Tactics and Tips in the Canadian Accounting Sector

Strategies for Crafting an Impressive Accounting Resume

Your resume is your first chance to make a positive impression on potential employers, so it’s essential to make it stand out. Whether you’re a recent graduate or an experienced accountant looking for new opportunities, these strategies will help you create a winning resume that gets noticed.

Selecting the appropriate resume format is the first step in crafting an impressive accounting resume. Choose the format that best suits your background and career goals. There are three common formats to consider:

- Chronological Resume: This format lists your work experience in reverse chronological order, starting with your most recent job. It’s ideal for those with a strong work history in accounting.

- Functional Resume: A functional resume focuses on your skills and qualifications rather than your work history. This format is suitable if you have gaps in employment or are transitioning to a new career.

- Combination Resume: Also known as a hybrid resume, this format combines elements of both chronological and functional resumes. It highlights your skills while also showcasing your work history.

Accounting requires a unique set of skills, and your resume should emphasize these skills. Some key skills to include are:

- Financial Analysis: Detail instances where you conducted comprehensive financial analysis, such as evaluating income statements, balance sheets, and cash flow statements. Showcase how your financial analysis contributed to informed decision-making, identified cost-saving opportunities, or improved overall financial performance.

- Accounting Software: Clearly state your proficiency in accounting software, such as QuickBooks, Excel, SAP, or other industry-specific tools. Outline specific tasks you’ve accomplished using these tools, such as ledger management, financial reporting, or budgeting.

- Attention to Detail: Share instances where your attention to detail ensured accuracy in financial records. This could include reconciling discrepancies, identifying errors, or maintaining precise documentation. Explain how your attention to detail contributed to the reliability of financial reports and compliance with accounting standards.

- Communication: Detail instances where effective communication was crucial in collaborating with clients, colleagues, or cross-functional teams. Showcase your ability to convey complex financial information in a clear and understandable manner, whether through written reports, presentations, or client interactions. Emphasize situations where your communication skills helped resolve financial queries or discrepancies.

Instead of just listing your job responsibilities, showcase your achievements. Did you save the company money through efficient financial management? Did you implement a new accounting system that improved efficiency? Use specific examples and quantify your achievements whenever possible. For instance:

“Implemented a cost-saving strategy that reduced annual expenses by 15%.”

“Managed a team of three junior accountants, resulting in a 20% increase in productivity.”

Highlight your accounting-related certifications, such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant). Mention your educational background, including the degree earned and the name of the institution. If you’re a recent graduate, you can also include relevant coursework or projects.

A concise resume is more likely to grab the attention of hiring managers. Aim for a resume length of one page for entry-level positions or two pages for more experienced roles. Use bullet points to make your resume easy to scan, and avoid long paragraphs.

Typos and grammatical errors can make your resume look unprofessional. Proofread your resume carefully and consider asking someone else to review it as well. Ensure consistency in formatting and style throughout the document.

Online Job Platforms for Accounting Opportunities

LinkedIn

LinkedIn stands as a powerhouse for professional networking and job hunting. With a dedicated job board and the ability to connect directly with recruiters, accounting professionals can leverage their profiles to showcase their skills and experience.

Indeed

Indeed has become synonymous with job searching across various industries, and accounting is no exception. Its user-friendly interface, extensive job listings, and personalized search filters make it a go-to platform for those seeking accounting opportunities.

Glassdoor

Glassdoor goes beyond job listings, providing insights into company cultures, salaries, and employee reviews. For accounting professionals keen on not just finding a job but also understanding the workplace environment, Glassdoor is an invaluable resource.

Canada Job Bank

As a prominent national job platform, the Canada Job Bank connects job seekers with employers across the country. It’s a valuable resource for accounting professionals looking for opportunities specifically within the Canadian job market.

Mastering the Art of the Accounting Job Interview

This goes beyond showcasing your technical skills; it involves a strategic blend of professionalism, communication, and a thorough understanding of the industry. In this guide, we’ll explore key strategies to help you confidently navigate the interview process and leave a lasting impression on potential employers.

1. Preparation: The Foundation for Success

Research the Company: Begin your preparation by delving into the company’s background, values, and financial standing. Understand its industry positioning and the specific challenges it faces. This knowledge demonstrates your genuine interest and sets the stage for meaningful conversations during the interview.

Review the Job Description: Analyze the job description thoroughly to identify the key skills and qualifications the employer is seeking. Tailor your responses to align with these requirements, emphasizing how your experiences make you an ideal candidate for the role.

2. Showcasing Your Technical Proficiency

Review Accounting Principles: Brush up on fundamental accounting principles and practices. Interviewers may assess your technical knowledge through scenario-based questions or case studies. Being well-versed in the essentials will boost your confidence and ability to respond effectively.

Highlight Relevant Experience: Draw attention to your relevant experience and accomplishments. Be prepared to discuss specific projects or challenges you’ve tackled in previous roles, emphasizing the positive outcomes and your contributions to the financial success of the organizations you’ve worked for.

3. Effective Communication Skills

Practice Common Interview Questions: Anticipate common accounting interview questions and practice your responses. This includes questions about your experience, handling tight deadlines, resolving conflicts, and adapting to changes. Practice ensures you articulate your thoughts clearly and concisely.

Use the STAR Method: When responding to behavioral questions, employ the STAR method (Situation, Task, Action, Result). Clearly outline the situation or challenge, the task you were assigned, the actions you took, and the positive results of your efforts. This structured approach provides a comprehensive and memorable answer.

4. Demonstrating Problem-Solving Abilities

Solve Sample Problems: Prepare for potential problem-solving exercises or case studies. Practice solving sample accounting problems to enhance your analytical and critical thinking skills. This will help you approach challenges with confidence during the interview.

Discussing Challenges and Solutions: When discussing your experiences, highlight instances where you faced challenges and successfully implemented solutions. This not only demonstrates your problem-solving abilities but also showcases your resilience and adaptability in dynamic work environments.

5. Cultural Fit and Soft Skills

Emphasize Soft Skills: Beyond technical proficiency, employers seek candidates who fit well into the company culture. Emphasize soft skills such as teamwork, communication, and adaptability. Provide examples of how you’ve collaborated with colleagues or contributed to a positive work environment.

Ask Thoughtful Questions: Prepare insightful questions to ask the interviewer. This demonstrates your genuine interest in the position and the company. Inquire about the team dynamic, company values, or opportunities for professional development.

6. Professional Etiquette and Body Language

Dress Professionally: Choose professional attire that aligns with the company’s dress code. A polished appearance conveys your commitment to professionalism and respect for the interview process.

Practice Positive Body Language: Maintain eye contact, offer a firm handshake, and sit up straight. Positive body language contributes to a confident and engaged demeanor. Non-verbal cues play a significant role in creating a positive impression.

7. Follow-Up Strategies

Send a Thank-You Email: After the interview, promptly send a thank-you email expressing your gratitude for the opportunity and reiterating your interest in the position. This simple gesture reinforces your enthusiasm and leaves a positive lasting impression.

Express Continued Interest: In your follow-up communication, express your ongoing interest in the role and inquire about the next steps in the hiring process. This showcases your proactive approach and commitment to the potential opportunity.

8. Continuous Improvement

Seek Feedback: If you receive feedback, whether positive or constructive, use it as an opportunity for continuous improvement. Reflect on the interview experience and identify areas where you can enhance your responses or presentation.

Stay Updated on Industry Trends: Keep abreast of industry trends, accounting standards, and technological advancements. Demonstrating a commitment to staying current enhances your credibility and positions you as a forward-thinking candidate.

Current Trends and Future Prospects in Canadian Accounting Careers

As accounting professionals chart their career paths, staying informed about current trends and future prospects is crucial. In this exploration, we delve into the prevailing trends and potential trajectories that are shaping the future of accounting careers in the Canadian context.

1. Technology Integration: The Rise of Automation

Current Trend: Automation and artificial intelligence (AI) are reshaping the accounting profession. Routine tasks, such as data entry and transaction processing, are increasingly being automated, allowing professionals to focus on more complex analyses and strategic decision-making.

Future Prospects: As technology continues to advance, accountants will likely find themselves in roles that require a deep understanding of data analytics, AI tools, and automation systems. Professionals who embrace these technologies will be better positioned to add significant value to their organizations.

2. Digital Transformation and Cloud Accounting

Current Trend: The adoption of cloud accounting solutions is gaining momentum. Cloud-based platforms offer real-time collaboration, enhanced data security, and accessibility from anywhere, transforming the way financial data is managed.

Future Prospects: The future of Canadian accounting careers is likely to involve a seamless integration of cloud-based technologies. Professionals with expertise in cloud accounting software, such as QuickBooks Online or Xero, will be sought after for their ability to streamline financial processes and enhance data accuracy.

3. Regulatory Changes and Ethical Practices

Current Trend: Increasing scrutiny and changes in accounting regulations, both domestically and internationally, are influencing how financial information is reported. Ethical considerations and transparency have become paramount in the wake of high-profile corporate scandals.

Future Prospects: Canadian accountants can anticipate a continued focus on ethical practices and adherence to evolving regulatory frameworks. Professionals with a strong ethical foundation and a keen understanding of compliance will be integral to maintaining the integrity of financial reporting.

4. Remote Work and Flexibility

Current Trend: The COVID-19 pandemic has accelerated the adoption of remote work in various industries, including accounting. Many professionals are experiencing greater flexibility and work-life balance through remote or hybrid work models.

Future Prospects: The future of Canadian accounting careers is likely to include more flexible work arrangements. Employers recognizing the benefits of remote work may continue to offer flexible options, and accountants who can effectively manage remote collaboration and maintain productivity will be highly valued.

5. Specialized Accounting Roles

Current Trend: Accounting is diversifying into specialized areas, including forensic accounting, sustainability accounting, and IT auditing. Organizations are recognizing the importance of specialists who can address specific challenges within the financial landscape.

Future Prospects: Canadian accountants can explore opportunities in specialized fields that align with emerging trends. Professionals with expertise in areas like sustainability reporting or cybersecurity auditing may find themselves in high demand as companies prioritize these specialized skills.

6. Continued Emphasis on Professional Development

Current Trend: The accounting profession places a significant emphasis on ongoing professional development. Continuous learning and staying updated on industry trends are essential for maintaining professional relevance.

Future Prospects: The future of Canadian accounting careers involves a commitment to lifelong learning. Accountants who actively pursue certifications, attend industry conferences, and engage in continuous education will be better equipped to navigate the evolving demands of the profession.

7. Environmental, Social, and Governance (ESG) Reporting

Current Trend: There is a growing focus on ESG factors in business decision-making. Companies are recognizing the importance of environmental sustainability, social responsibility, and strong governance practices in their operations.

Future Prospects: Accountants with expertise in ESG reporting will likely be in demand as organizations aim to align with global sustainability goals. Professionals who can navigate the complexities of ESG reporting will play a vital role in helping businesses demonstrate their commitment to responsible practices.

Conclusion: Adapting for Success

Being successful in Canadian accounting jobs is about adapting to changes. The future brings both challenges and chances for growth. People who welcome new technologies, keep up with rules, and learn special skills will do well. If Canadian accountants join in making accounting better, they can face the future with confidence. This way, they can help businesses and the whole economy as they change and grow.