A Comprehensive Immigration Guide on Canada Child Benefit

Home » Blog » Life in Canada Guides » What is Canada Child Benefit? Complete Guide for Canada Immigrants

👨👩👧👧 Explaining the Canada Child Benefit

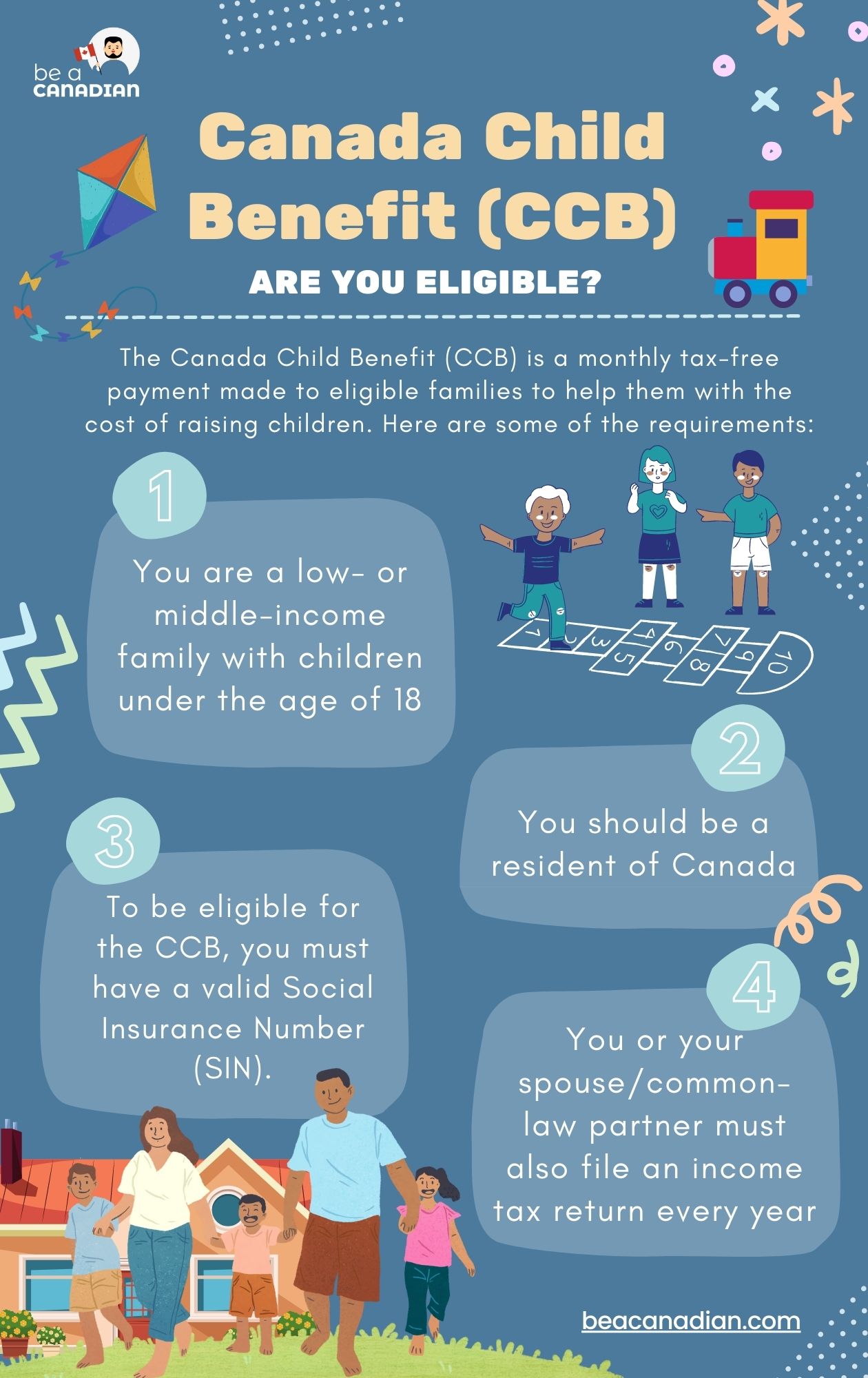

The Canada Child Benefit (CCB) is a monthly tax-free payment made to eligible families to help them with the costs of raising children. The CCB may include payments for each child under the age of 18 in the family.

Families receive the CCB regardless of their employment status. However, the amount of CCB a family receives is based on their family income and the number of children in the family. Families with lower incomes receive higher benefit amounts.

The CCB is paid out by the Canada Revenue Agency (CRA) every month, and families can choose to have the payments deposited directly into their bank account or receive them by cheque.

The CCB is one of several benefits available to families with children in Canada. Other benefits include:

This provides families with $100 per month for each child under the age of six.

Provides low-income families with additional monthly payments.

Quick Links:

📑 How to apply for the Canada Child Benefit?

If you are a new parent living in Canada, you may be wondering how to apply for the Canada Child Benefit (CCB). To be eligible for the CCB, you must have a valid Social Insurance Number (SIN) and be a resident of Canada. You can apply for the CCB online, by phone, or by mail.

To apply online, you will need to:

- Create a My Account with the Canadian Revenue Agency (CRA).

- Login and complete the application form.

- Provide your personal information, as well as information about your child or children.

To apply by phone, you can call the CRA’s Individual Enquiries line at 1-800-959-8281. To apply by mail, you can download and print the application form from the CRA website and then mail it to:

Taxpayer Services and Debt Management Division

PO Box 9769 Station T

Ottawa ON K1G 3Y4

🗂️ What are the Benefits of the CCB Program?

The CCB may be used to pay for a variety of costs related to raising children, such as:

- Food

- Clothing

- Shelter

- Transportation

- Recreation and entertainment

- Child care expenses

- Education costs

The CCB can also help families reduce their overall costs of living by freeing up money that would otherwise be spent on these necessities.

💵 How to Receive Canada Child Benefit Payments

To receive the CCB, families must file an annual income tax return. Payments are made to the family’s primary caregiver, who may be the mother, father, or another relative or legal guardian.

Families can receive up to:

- $6,400 CAD per child under 6 years of age

- $5,400 CAD per child aged 6-17 years old.

The amount a family receives is based on their household income and the number of children in their care. Families with lower incomes will receive a higher benefit amount than those with higher incomes.

Payments are typically made by direct deposit into a bank account on the 20th of each month. However, if the 20th falls on a weekend or holiday, payments will be made on the next business day.

🍁 Conclusion

Canada Child Benefit provides a great opportunity for Canada immigrants to get financial support for raising children in their new country. It has helped many families by reducing the overall cost of living and providing additional funds that can be used to purchase items like clothing, educational materials, toys, and other necessary items.

The CCB is an important program for people who are looking to establish themselves and raise a family in Canada as it helps ease some of the financial burden associated with this transition process.